Individual 401k calculator

Also the Individual 401k allows the flexibility to borrow against the value of your 401k. TIAA Can Help You Create A Retirement Plan For Your Future.

How Much Can I Contribute To My Self Employed 401k Plan

Forbes Advisors 401 k calculator can help you understand how much you can save factoring in your.

. It provides you with two important advantages. Using the retirement calculator you can calculate the maximum annual retirement contribution limit based on your income. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

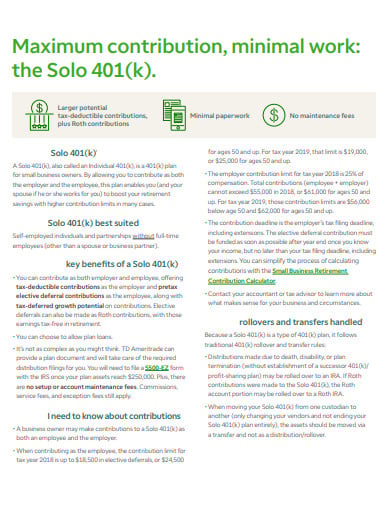

Self-employed 401 k calculator - individual 401 k contributions Calculate your earnings and more Self-employed individuals and businesses employing only the owner partners and. Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment. A Solo 401 k.

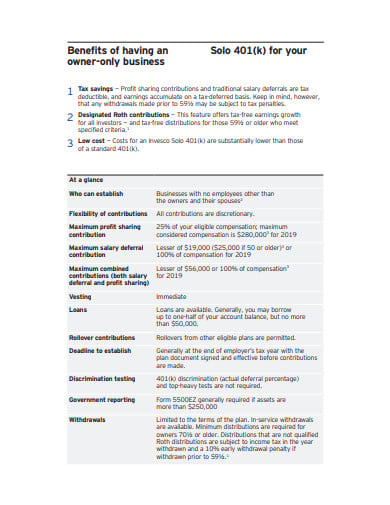

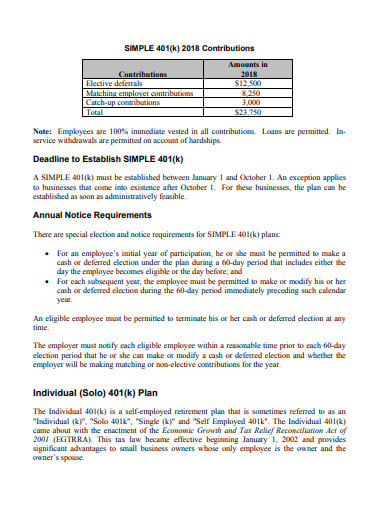

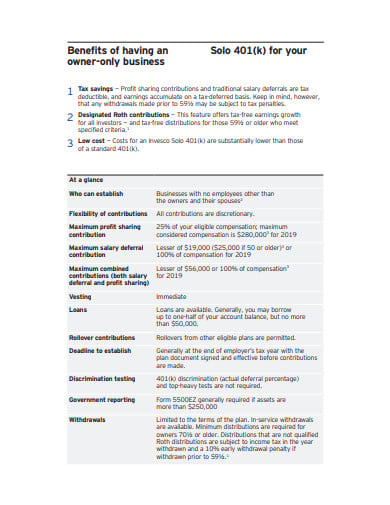

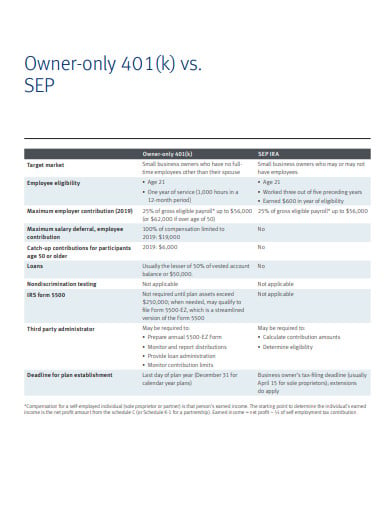

A 401k is a type of account where individuals deposit the amount pre-tax and defer the payment of taxes until withdrawing the same at the time of retirement. Use the Individual 401 k Contribution Comparison to estimate the potential contribution that can be made to an Individual 401 k compared to Profit Sharing SIMPLE or SEP plan. Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such.

Enter your name age and income and then click Calculate The. According to the Individual 401 k calculator plan participants are entitled to loan 50 of the total plan value or balance or 50000 whichever is less. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement.

This calculator assumes that your return is compounded annually and your deposits are made monthly. Dont Wait To Get Started. Self-employed 401 k Self-employed individuals owner-only businesses and partnerships can save more for retirement through a 401 k plan designed especially for you.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Individual 401 k Savings Calculator. In 2020 the maximum contribution to an Individual 401 k is 57000 for individuals under 50 and for individuals age 50 and over there is an additional 6500 catch-up contribution.

Ad Choose Your Plan and Calculate Between Several Options for Tax-Advantaged Savings. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Individual 401k Savings Calculator.

The annual rate of return for your Individual 401 k account. Home Calculators Individual 401k Calculator. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment.

Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. This is the maximum amount you are allowed to contribute to your Individual 401 k account per year. Reviews Trusted by Over 45000000.

Ad Compare 2022s Best Gold IRAs from Top Providers. 401k loans up to 50 of the total value of the 401k up to a 50000 maximum are permitted. In 2022 the maximum contribution to an Individual 401 k is 61000 for individuals.

Calculator to Estimate Potential Contribution That Can Be Made to Individual 401K Plans. The actual rate of return. Contributing to a 401 k is one of the best ways to prepare for retirement.

If your business is an S-corp C-corp or LLC taxed as such. Solo 401k Contribution Calculator.

Solo 401k Contribution Calculator Solo 401k

Solo 401k Contribution Limits And Types

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Solo 401k Contribution Limits And Types

Here S How To Calculate Solo 401 K Contribution Limits

2

Retirement Services 401 K Calculator

How Much Can I Contribute To My Self Employed 401k Plan

How Much Can I Contribute To My Self Employed 401k Plan

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

9 Self Employed 401k Calculator Templates In Pdf Free Premium Templates

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Solo 401k Contribution Calculator Solo 401k